In this article I dive deeper into what’s driving Algorand’s TPS and what Cardano can learn from it. But lets start by first by explaining TPS better.

TPS is about transaction volume not speed

Here is a chart generated through Coin Metrics

A simpletons interpretation of this chart would be “Oh this shows Algorand is super fast, followed by Ethereum, with Cardano being very slow”.

To understand why that the is the wrong conclusion to be drawn from the chart see how CoinMetrics define TPS:

“Tx per Second: The sum count of transactions divided by the number of seconds that day.”

So take all the activity that happened on a chain on a given day, and divide it by the number of seconds in that day. On most days the limiting factor is how much activity is actually taking place on the chain, not the speed it can operate at. If you wanted to compare the maximum speed each chain can operate at, then you would need to completely spam them with similar types of transaction, and then see how many get processed. On most days, especially in a bear market, the volume of transactions is no where near enough to max out the network in order to perform this test. Therefore instead what you end up with is a metric that is showing how much activity there is on a chain.

More questions

Ok so if TPS is a measure of activity on a chain does this mean that Cardano has very low activity and Algorand has an insane amount? Well certainly Cardano has a lower level of activity than market leader Ethereum, so that is to be expected. But the outlier on the chart above is Algorand. Why does Algorand have a TPS of 63 when Ethereum only has 11? If you are about to shout out “Because Algorand is faster!” then please go back and read the last section.

Well first off, this TPS is a little dubious when you look at the https://algoexplorer.io/ and see they show a TPS of 11.

It’s also interesting to see there are regular spikes in transaction volume on the Algorand network – what is driving that?

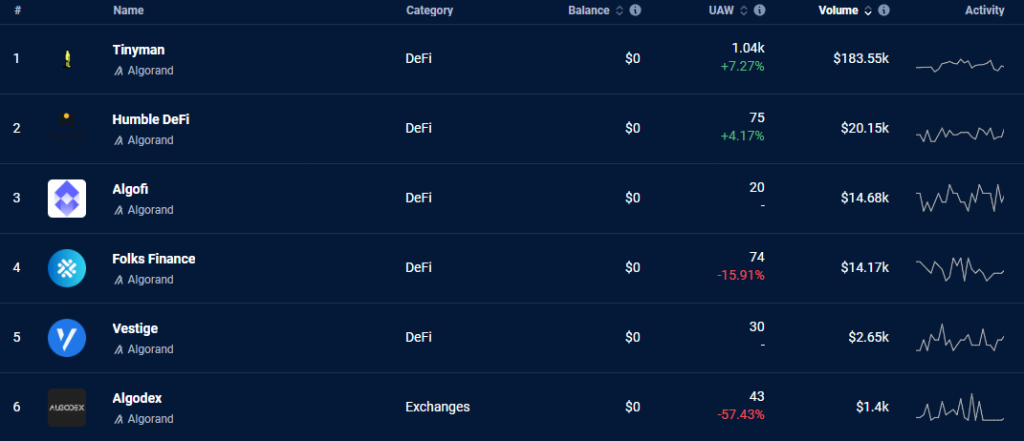

I also went over to DAppRadar to see if I cold spot what was driving the Algorand volume.

The UAW column here is the number of Unique Active Wallets, and the Volume is the $ value of the transactions that took place. If Algorand has a high TPS I’d expect it’s UAW and Volume to be high.

What I see on this table though is that there’s only one popular DApp on Algorand – Tinyman with 1.04k users and $183k in volume in a 24 hour period. The rest has less than a hundred users and volume of less than $20k.

Let’s benchmark this against Ethereum:

Straight away we can see Ethereum has much higher volumes and several DApps that have significantly more than the 1.04k users that Tinyman had.

Explore the explorer

So what gives? What is the true TPS on Algorand and what is driving it? To be fair, measuring volume in terms of dollar value is not the same as measuring transaction volume. You could have lots of low $ value transactions taking place. But where can I see a ranking by transaction volume? I couldn’t think of anywhere so I did the next best thing. I sat and watched transactions coming in on Algorand to see if I could spot a pattern. Give it a try, it’s not as dull as you think (ok well it is but still give it a try!).

I’m sure you’ll spot two things quite quickly: There is a lot of transactions for 0 planets and 1 LCBZR. A quick google revealed the first one was related to this deal.

This is a legit deal, a great use case for blockchain and a great way to boost TPS given that IOT transactions are small but numerous.

LZBZR (LC Blitz Ranking) was a little harder to figure about but I’ve traced it to this deal.

This is another legit deal and great use case for blockchain. There is even a good Wired article about it.

What this means for Cardano?

So I figured out what was driving a high number of transactions on Algorand. And I suspect the difference between whether Algorand’s TPS is 11 or 63 may be down to how each site calculates it. The Algorand explorer has it as “the average transactions per second for the past 24 hours, which implies they are tracking TPS on a second by second basis then averaging it out. But this just shows how inconsistent TPS as a measure is (really there should be one standard industry definition).

I also repeated the same “explore the explorer” exercise for Ethereum and found that a lot of transactions were OpenSea and DeFi related which is as one would expect.

But putting that all aside, what does this mean for Cardano? Why is Cardano’s TPS low and what can be done to boost it.

Well by now you should be able to answer these questions for yourself.

Cardano’s TPS is low because it doesn’t have the level of DeFi and OpenSea activity as the industry leader, Ethereum, which is as expected. But it also has a lower TPS than Algorand because it does not have IOT projects recording small transactions to the blockchain on a regular basis. Boosting human activity in DeFi and NFT projects, or sensor activity in IOT projects is therefore how Cardano can boost it’s TPS.

This raises the question of whether World Mobile Token (WMT), the most famous (possibly only?) IOT project on Cardano, has started recording it’s data to the blockchain yet. I believe the answer is no and that most of Cardano’s transactions consist of DEX activity like Sundaeswap or Minswap but I’ll let others confirm that.

Bringing WMT onto Cardano and funding other IOT projects is therefore the best way to rapidly increase Cardano’s TPS.